Improving Returns by Delaying Taxes

Taxes substantially impact investment returns. But do you know that you can reduce their effect and boost returns by using the time value of money (TVM) ? Intrigued? Let’s dive in.

As a corollary of the time value of money, tax that is payable in the future, also known as deferred tax, is strictly better than the same amount payable today.

Thus, any provision that allows deferring taxes improves returns, even if the tax amount will be the same in future. And the longer you can postpone the payment, the more beneficial it is.

The idea of increasing returns by deferring taxes finds application in two places:

- Comparing Investment Avenues

- Tax-Loss Harvesting

Comparing Investment Avenues

Given similar risk, rate of return, and tax rate, investments that require taxes to be paid on redemption provide higher post-tax returns than those for which taxes are to be paid in the interim.

Let’s consider the growth of ₹100 over a period of 10 years, given different tax treatment:

| Tax at Redemption | Tax on Accrual | |

|---|---|---|

| Growth Rate | 7.0% | 7.0% |

| Tax Rate on Accrual | 0 | 30% |

| Corpus after 10 years (Pre-Tax) | ₹197 | ₹161 |

| Tax Rate at Redemption | 30% | 0 |

| Final Corpus (After Tax) | ₹168 | ₹161 |

All mutual fund investments fall in the tax-on-redemption category: you need to pay the tax only when you realise the gains through sale. On the other hand, investments such as Fixed Deposits (FDs), National Savings Certificates (NSC), etc, fall in the tax-on-accrual category: you need to pay tax every year on the accrued interest.

Tax-Loss Harvesting

Tax-Loss Harvesting (TLH) involves intentionally selling an investment at a loss and repurchasing it at the same price, effectively realising a notional “loss”. The net portfolio value, however, stays the same before and after the sale.

This capital “loss” can be used to offset capital gains, reducing your tax liability. In case losses exceed the gains in a year, you can carry forward the remaining losses. These can be used to offset gains in up to the next 8 assessment years.

You can use any type of financial asset for TLH: individual stocks, mutual funds, gold etc.

At first glance, TLH may seem like a no-brainer way to save on taxes. But if you look closer, you would realise that by selling and buying back the investment at a loss lowers your purchase price, also known as the cost basis. As a result, when you sell it in the future, the capital gains will increase by the same amount as the loss harvested.

Loss harvesting thus effectively transfers capital gains from one asset to another.

But if the gains get only transferred and not eliminated, what’s the point? As you can guess: time value of deferred taxes.

If you don’t intend to immediately liquidate the asset used for TLH, loss harvesting lets you postpone the tax payment a few years down the line, creating value through time value of money.

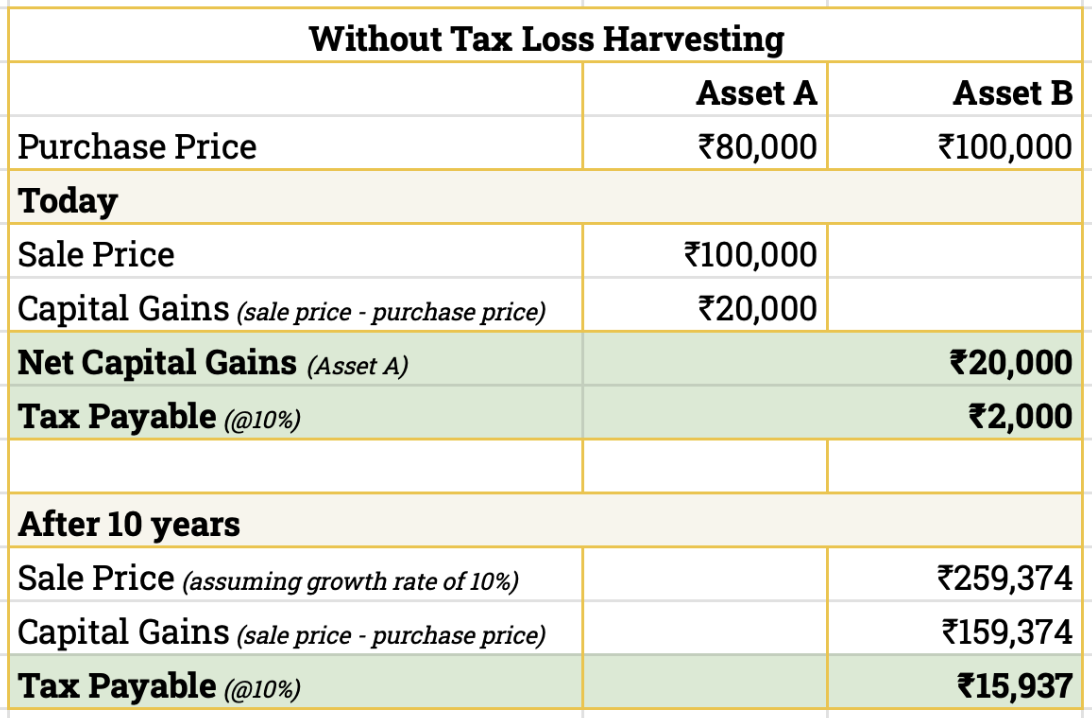

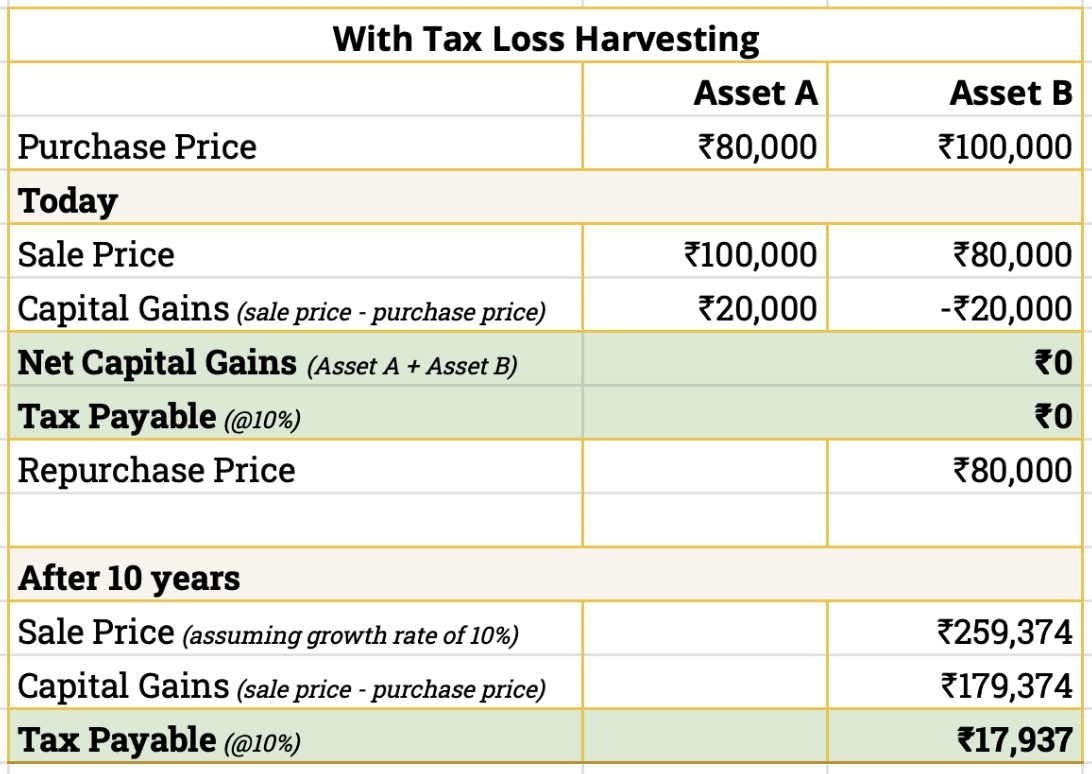

Let us better understand this through an example: say, you have two financial assets A and B. You bought A for ₹80,000 a few years back and sold it recently for ₹100,000. You bought B for ₹100,000 with an intention to sell after 10 years. B is currently down 20%, providing an opportunity to harvest the losses.

As you would notice, by doing TLH, your current tax obligation of ₹2,000 gets postponed by 10 years. Due to time value of money, the payment in future is of lesser value than if it had been due today.

To quantify the savings from deferred taxes, one needs to discount the tax payment of ₹2,000 after 10 years, to today. Assuming a discount rate of 7% (the prevalent risk-free rate), the present value of the tax reduces to ₹1016. Thus, TLH helped you save 49% in taxes!

Now, if you sell B after 20 years instead of 10, the payment will get deferred by 20 years. Discounting ₹2,000 at 7% for 20 years, the present value of the tax obligation decreases to ₹517. A 74% reduction!

As you can see, the longer the time gap between harvesting the loss and selling the investment, the higher the gains. Investments earmarked for long-term goals like retirement are, therefore, a great choice to harvest losses.

To maximize the benefit from loss harvesting, lookout for:

- short-term losses, to offset short-term gains

- losses from low-tax rate assets, like equities, to cancel out gains from high-tax assets like debt funds.

- or a combination thereof — the most rewarding

This way, you will benefit not only from deferred taxes but also from lower tax rates.

Now, despite the huge potential to help save on taxes, loss harvesting has its downsides. For one, it requires extra effort to keep an eye out for loss harvesting opportunities throughout the year. You can’t schedule loss harvesting to be done in only March as the opportunity to book losses may not exist then.

Second, it adds a little complexity to the process as your investments should be spread across different folios to best take advantage of these opportunities. Third, you need idle capital to harvest losses in a risk-free fashion. However, you can easily surmount that challenge as we’ve discussed here.

It is important to keep in mind that deferring taxes removes the certainty regarding the tax rate. If the government increases the tax rate on capital gains in future, you could end up paying more. Dramatic increases are infrequent though.